Xpel - My Quest For The Holy Grail Of Investing

If you could have only purchased Walmart when the company IPOd and held till today, you’d be a gazillion-aire.

- Or Southwest Airlines from 1971.

- Or Netflix from 2012.

- Or Berkshire Hathaway from 1970.

- Or Monster Beverage from 2003….

Yeah, yeah. Hindsight is 20/20. Who on earth was lucky enough to spot those opportunities, bet big and possessed the cojones to hold them for decades?

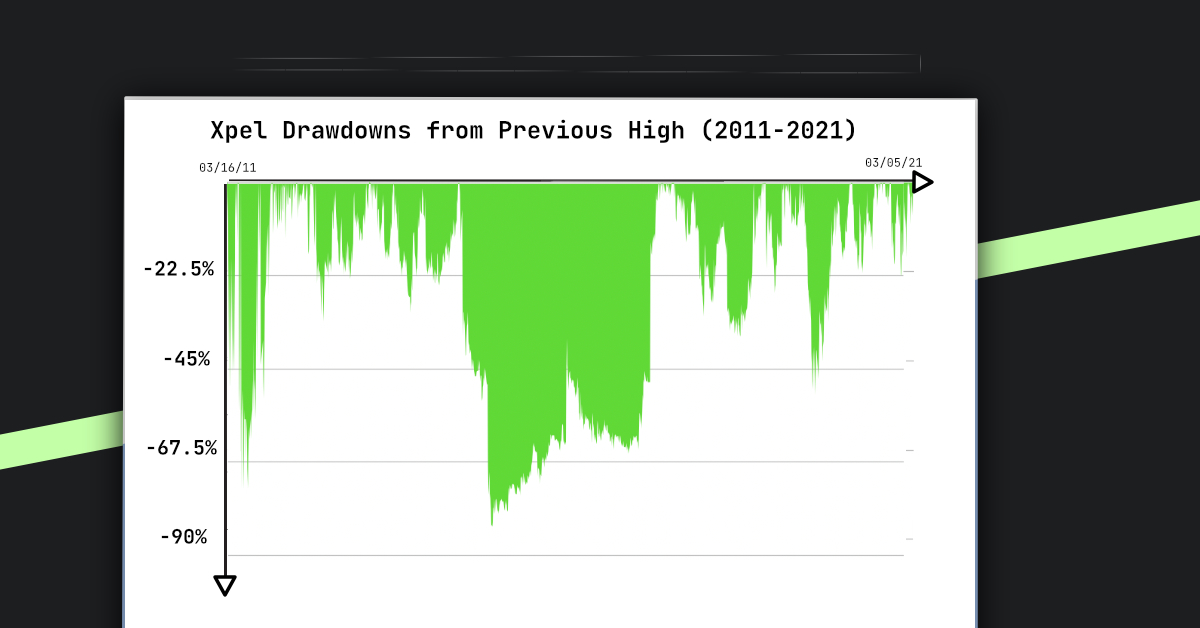

Through some epic drawdowns.

And through decades of ever increasing share prices?

Practically no one.

What I’m describing IS INVESTING’S HOLY GRAIL. 50 baggers. 100 baggers. 1000 baggers.

Achieving the Grail in investing is much more difficult than the Knight’s of the Round Table had it. Those Knights just had to find the treasure. Investors have to find what they think is the Grail and then be subjected to the ride of their life for decades.

Most lucky enough to find these companies and invest early get too beat up in the drawdowns. Some sell after making a few dollars. And the rest get too bored, sell and buy some shiny turd.

So it is next to impossible to achieve the Grail, but possible. Those are challenges I like.

I set out on the quest and achieved it with Xpel. Let me walk you back through my quest with a good heaping of Monty Python’s Quest For the Holy Grail.

This will be very long. Included are many of the qualitative cues and diligence that helped me on my quest with Xpel.

Patsy

It’s early 2014. I was 25 years old.

I recently divorced my Korean wife after 2 weeks of marriage. Story for another day.

I had just quit working at a small wealth management firm.

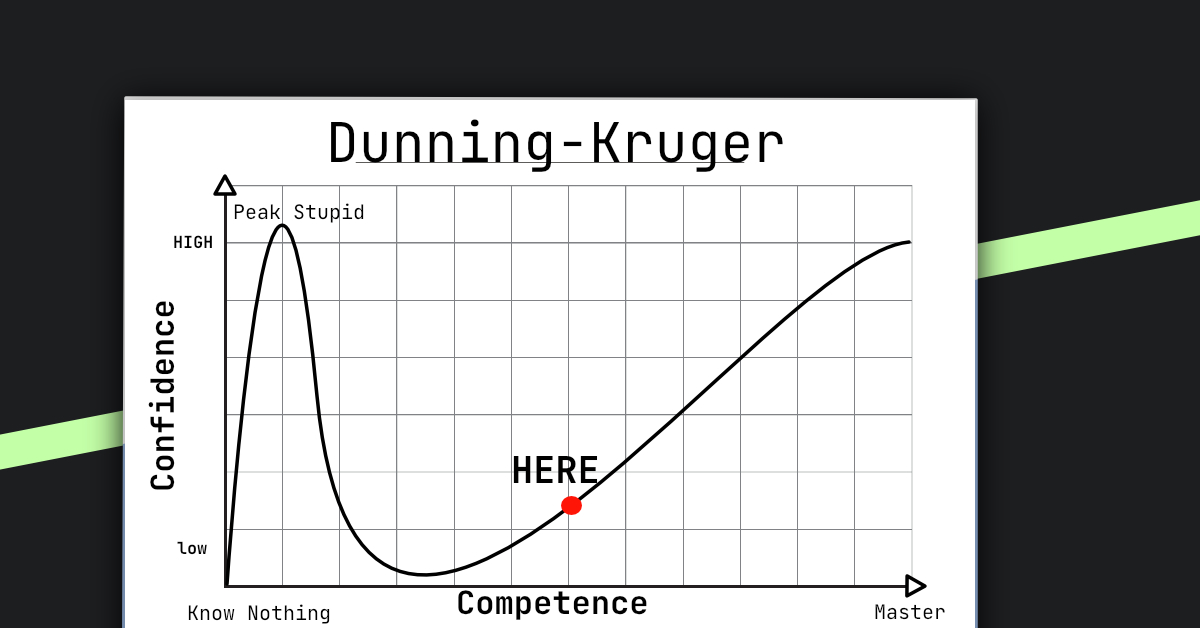

I had been investing for 6 years. My returns overall were pretty terrible by then.

I was buying things like JCPenny and Tesco, pretty terrible companies.

I had one good investment in Idenix (lucky), but I didn’t invest enough into it to make a dent.

I read investment books, but I still really didn’t get it.

I didn’t have a lot of money.

I had just started a registered investment advisory firm called Unconventional Capital Wisdom LLC to manage other people’s money.

I definitely was the Patsy at the card table clapping my coconuts together.

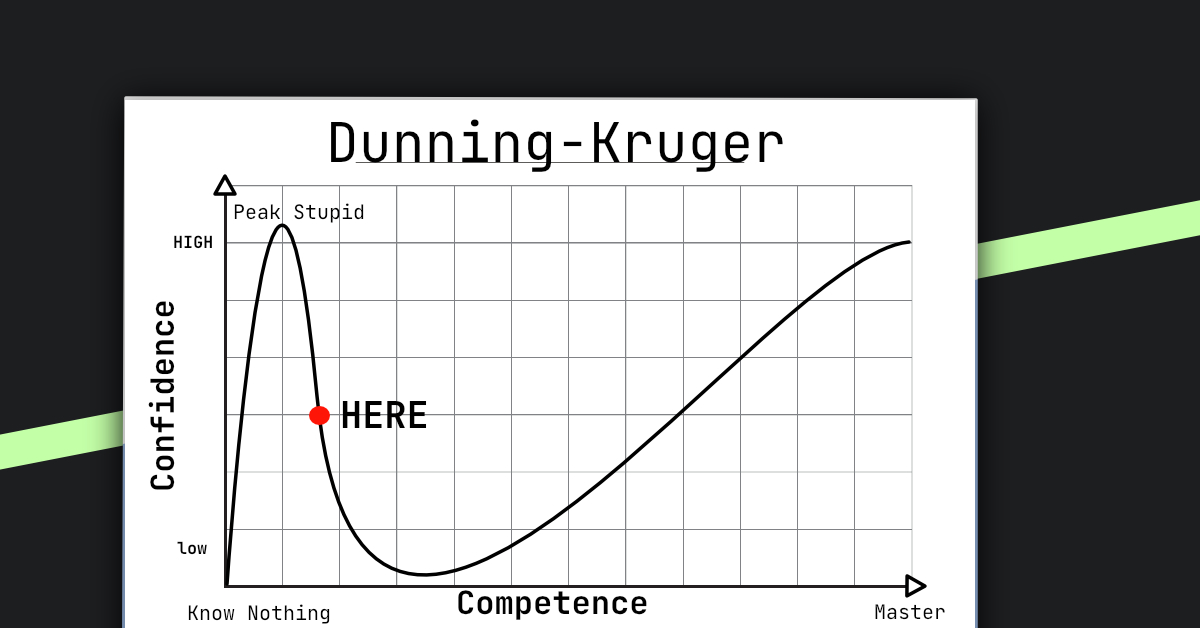

If I were to map myself on the Dunning-Kruger Effect, I’d be about here.

To show how confident and stupid I was at the time, I even once tried to convince Cornell University’s Endowment to seed me as an emerging manager.

I fumbled through the meeting.

I got laughed out of the building.

That really ticked me off but it was an awakening.

As I walked to one of Cornell’s libraries one day I asked myself, “Could I find the next Walmart or Monster Beverage?”

My mind raced.

“And when I do find the ONE, can I bet the farm & hold through some terrifying shit? Can I not sell out when things were getting good? And could I not get bored looking for the next shiny turd I walk by?”

Is it just luck?

An image of Ben Franklin appeared in my head and said, “Life’s tragedy is we are too soon old and wise too late.”

“If only I was wise young,” I thought. “Then I’d be able to spot the next great company, bet big and hold through the crazy rollercoaster.”

To this point I had been a musician. I went to Berklee College of Music. I studied Music Therapy. Not the pedigree of a Multibagger Grail seeker.

Or was it?

From Patsy to Arthur

Experience alone does not bring wisdom regardless of how much knowledge one possesses. Nor does age.

Investing, & life, is like a jig-saw puzzle. The pieces to the puzzle are each made of different kinds of knowledge. Wisdom is the understanding of how the pieces fit together and a vision of how the completed picture puzzle forms.

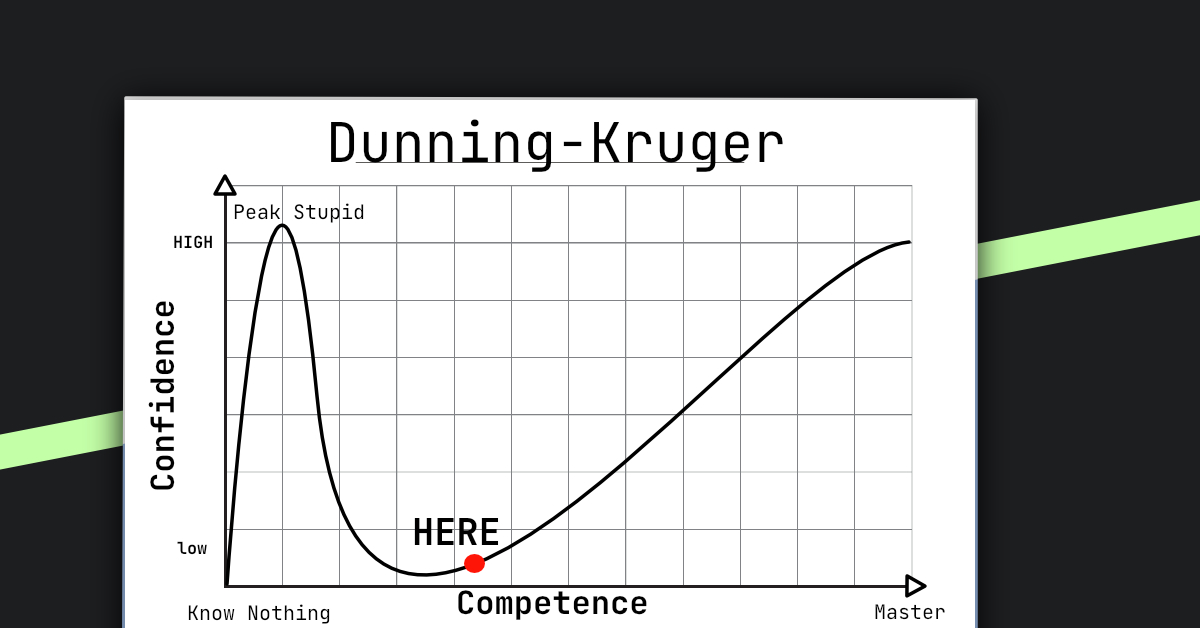

I admitted I was a Patsy.

Patsies try to experience everything themselves. They make mistakes and go down dead ends. They can spend their whole lives making mistakes. If they’re lucky, one day they figure it out. Go this route and it’ll be too late. But figuring it out even in old age is no guarantee.

This admission immediately threw me to about here.

This is where my music background came in handy.

Musicians don’t go at it alone. Like King Arthur they seek out people better than themselves. Both indirectly and directly.

The best musicians also invert. They use others' hindsight as their own foresight. With the right work, what they call wood shedding, they can become young and wise.

And I’m not talking about wood shedding other people’s mistakes.

No musician figures out music by avoiding wrong notes. Like Arthur they stroll right on by the mistakes internalizing the right notes.

Okay, back to the Quest.

Find ‘Em Small

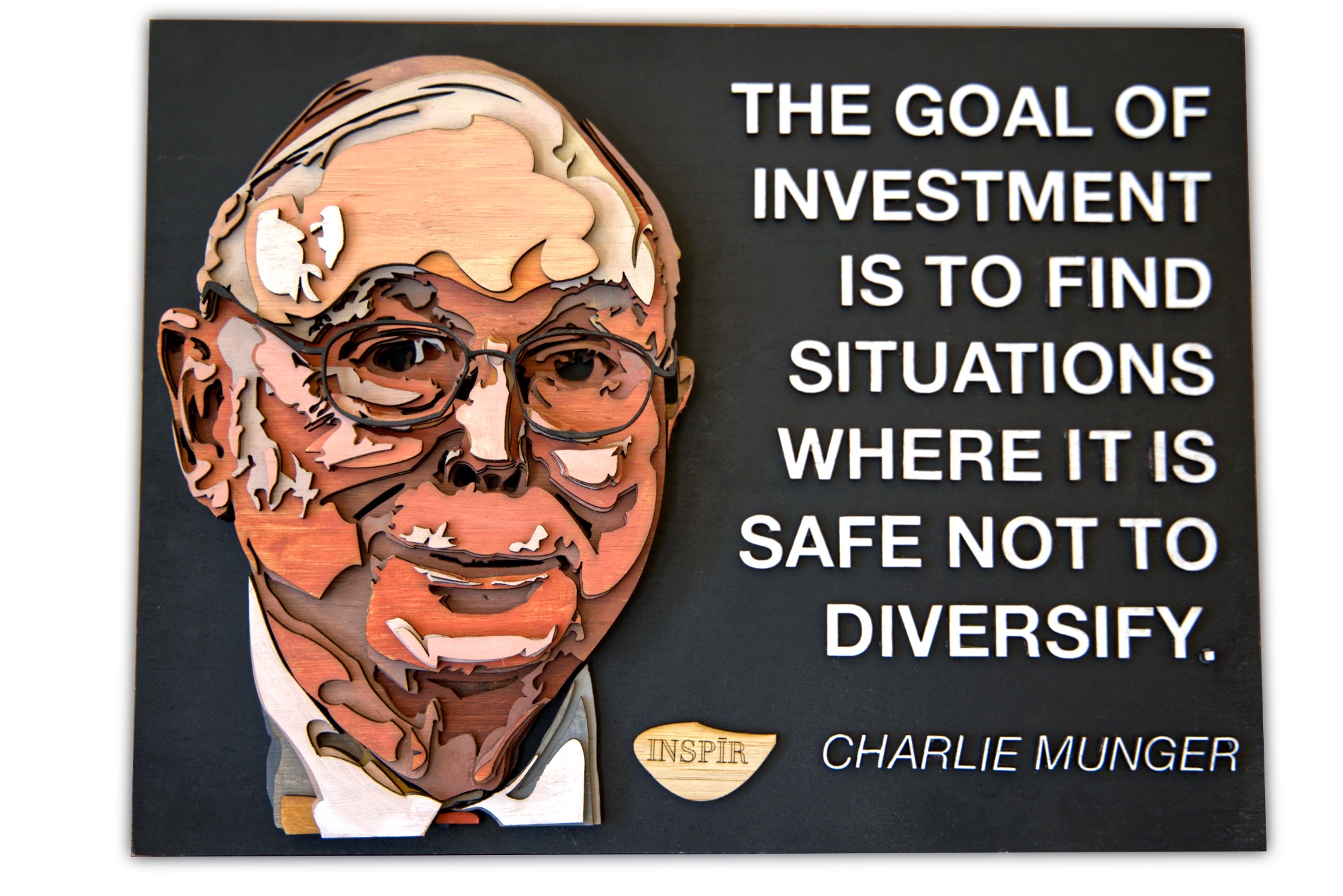

Charlie Munger’s advice 👇 was where I started:

One method is what I’d call the method of finding them small get ‘em when they’re little. For example, buy Wal-Mart when Sam Walton first goes public and so forth. And a lot of people try to do just that. And it’s a very beguiling idea. If I were a young man, I might actually go into it.

To find a great company early, you gotta start small.

So I sought out MicroCapClub (MCC). I knew at least I’d be rubbing shoulders with some of the smartest people in the space.

The only way to get into MCC then was by submitting a writeup on a micro cap company. Members then select who to admit based on the writeup.

My MCC application was for a tiny bank in Santa Barbara California called American Riviera Bank (ARBV). For the 2 or so people that were the deciding vote on becoming a member 🙏

It wasn’t a great writeup nor a fantastic idea.

Inverting The Path - Wal-Mart

Next, I tried to retrace the steps of early Wal-Mart. The company IPOd in October of 1970. By then Wal-Mart had been open for over a decade. So there was already a track record.

I vacuumed up everything I could find. I read Sam Walton’s Made in America. I read every financial report from the company since its IPO. I read every newspaper clipping on Wal-Mart in the library, both pre IPO and after.

Videos on Youtube? I watched them all.

I summed up my research by writing:

There is no year, that I can find, that Walton did not grow his stores’ revenues and profits.

Walton provided key insights in how he was able to maintain his culture of excellence.

The most important, top-level principle was:

For my whole career in retail, I have stuck by one guiding principle: The secret of successful retailing is to give your customers what they want.

And Walton described six more principles that he and his team abided by that produced immeasurable dividends:

1. Think one store at a time: That sounds easy enough, but it’s something we’ve constantly had to stay on top of.

2. Communicate, communicate, communicate: If you had to boil down the Wal-Mart system to one single idea, it would probably be communication because it is one of the real keys to our success. What good is figuring out a better way to sell beach towels if you aren’t going to tell everybody in your company about it?

3. Keep your ear to the ground: A computer is not - and will never be - a substitute for getting out in your stores and learning what’s going on. In other words, a computer can tell you down to the dime what you’ve sold. But it can never tell you how much you could have sold. That’s why we at Walmart are just absolute fanatics about our managers and buyers getting off their chairs here in Bentonville and getting out into those stores. We have 13 airplanes - only one of them a jet, I’m proud to say - and that’s why they’re there. We stay in the air to keep our ear to the ground.

4. Push Responsibility - and authority - down: The bigger we get as a company, the more important it becomes to shift responsibility and authority (toward the front lines, toward that department manager who’s stocking the shelves and talking to the customer).

5. Force ideas to bubble up: This goes hand in hand with pushing responsibility down. We’re always looking for new ways to encourage our associates out in the stores to push their ideas up through the system. We do a lot of this at Saturday morning meetings. We’ll invite associates who have thought up something that’s really worked well for their store - a particular display - to come share those ideas with us.

6. Stay lean, fight Bureaucracy: Any time a company grows as fast as Walmart has, pockets of duplication are going to build up, and there will be areas of the business that we may no longer need. No boss or employee really likes to dwell on such matters it’s only human nature not to want to have your job, or the jobs of the people who work for you, eliminated.

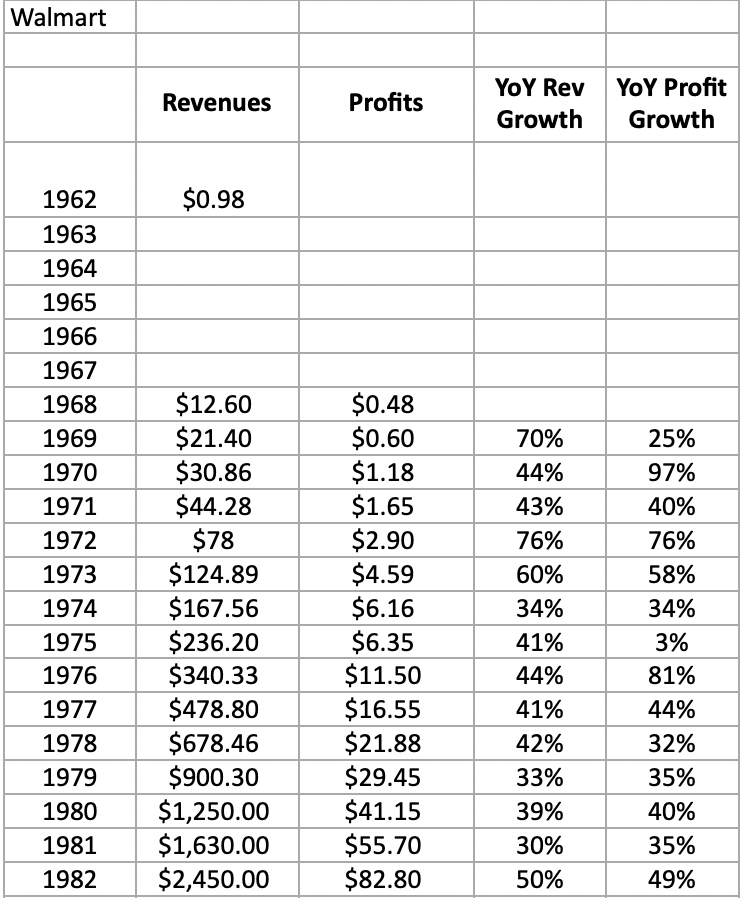

I sketched out a financial picture of the Wal-Mart’s growth in revenues and profits since it’s founding (as best as I could):

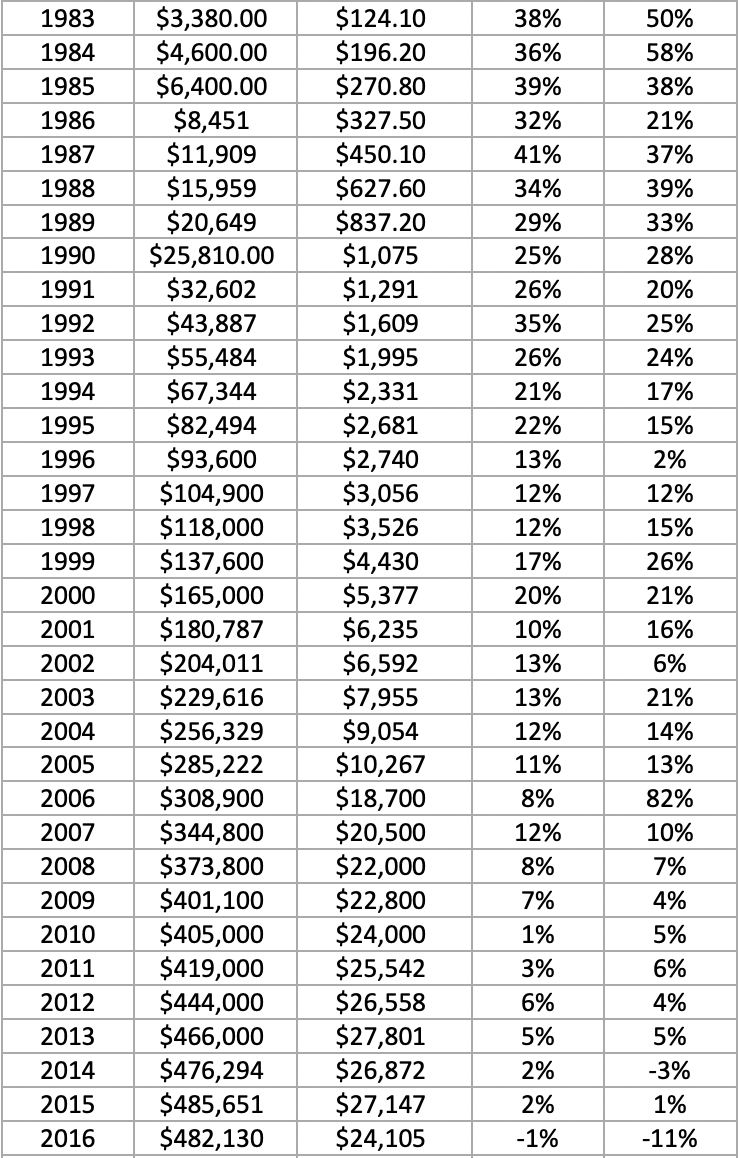

I sketched out Wal-mart’s share price (from ‘72 is as early as I could get):

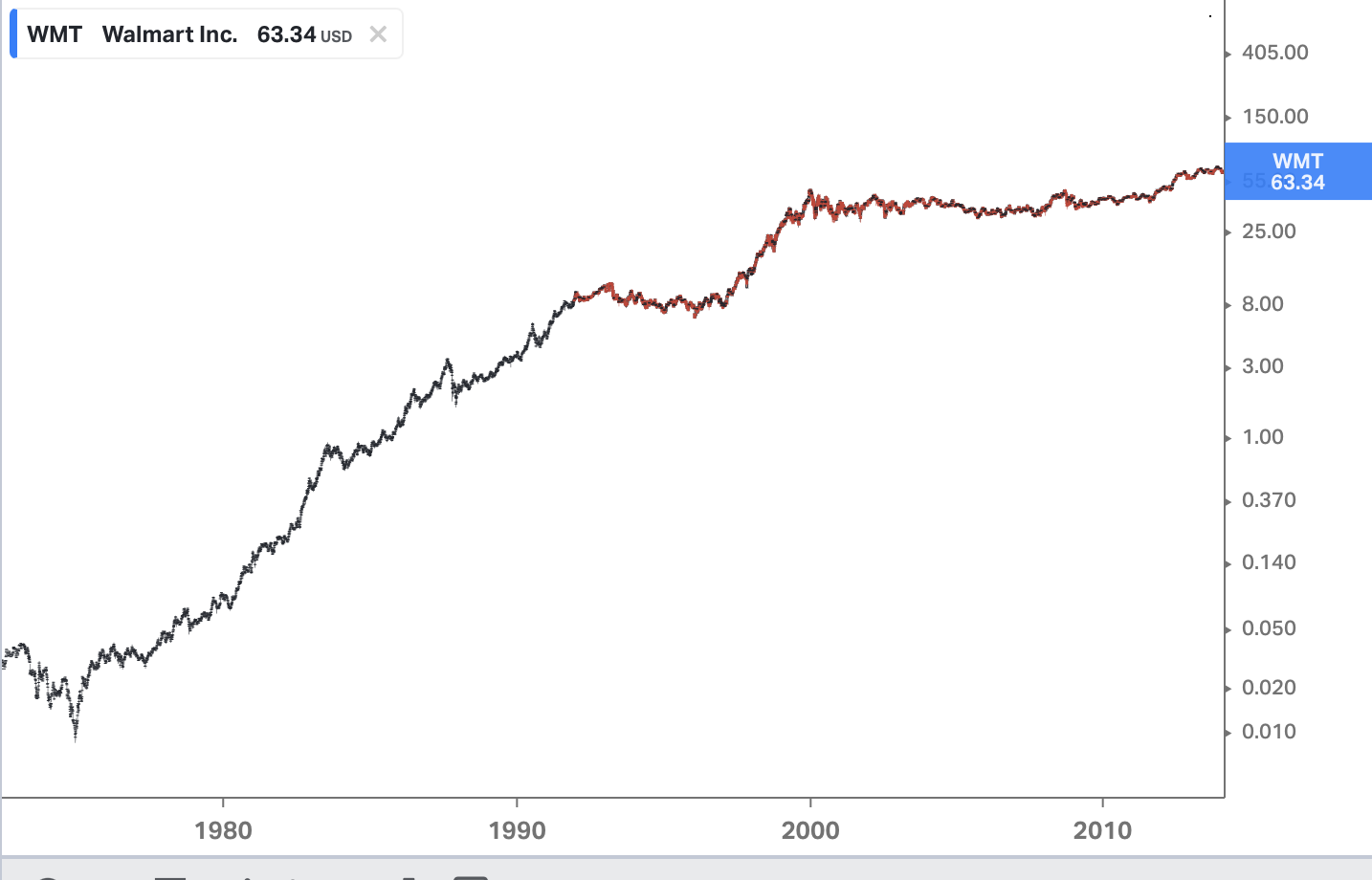

And I counted all of the drawdowns in the stock from 72-98:

Over the initial 26 years, Wal-Mart’s stock was down:

- [>20%] 33.2% of the time = 2,152 days

- [>30%] 14% of the time = 907 days

- [>40%] 6.4% of the time = 419 days

- [>50%] 4% of the time = 259 days

- [>60%] 1.4% of the time = 91 days

- [>70%] 0.45% of the time = 29 days

I was especially surprised with the huge sell off starting Nov 27, 1972 lasting until Dec 23, 1974. Shares fell 72.5% and hung there 8 trading days.

It took Wal-Mart until Oct 3, 1977 to reach it’s previous high from 1972.

I imagined how it must have felt to invest in Wal-Mart in 1972 and watch the stock drop MORE THAN 70%!

🤮🤮🤮🤮

Then have to wait another ~3 years to make break even.

Of course this guy and a few of the other people inside Wal-Mart held for much longer. They were handsomely rewarded. So it is possible, yet next to impossible.

What did I learn?

1/ If I wanted to go on this quest, I’d need to have 🎱🎱 of steel to take the 😱 stock drops

2/ Sam Walton even from the early days displayed a special fanaticism. Taking all the best ideas from others and making them better. He acted like a great musician.

2a/ i.e. Walton stole Sol Price’s best ideas all the way down to the name Fed-Mart. He also borrowed Fred Meijer’s idea of the supercenter. The list goes on and on and on.

3/ Always listening to team members - business to him was a team sport.

4/ Had integrity & persistence

5/ The incentive structure also was 🎯

Studying Wal-Mart & Sam Walton left me with more questions than answers.

- Did other multi baggers have similar trajectories & leaders?

- Who are all these people Sam Walton learned from?

- Charlie Munger has mentioned a boat load of other great companies, are they similar?

Entering MicroCap Land

I now had a microscopic view of what I wanted to find. So I looked back to MCC to see all of the companies being profiled.

I feel like for the first few months I read everything. And I read as much about all of the members in the club and outside of the club as possible. My goal was to try to learn as much as possible.

Companies that I wrote in my notes that were interesting at the time (from MCC and my own work):

- Avante Logixx

- PFHO

- PKT.V

- AUXO (now CTEK)

- Xpel

- TPNL (now PAYS)

- RX.V

I invested in all of those companies. But looking from the lens of my Wal-Mart study, Xpel, to me, stood out. And really thanks to all of the initial work from @PaulAndreola, educatedidiot, @SeanMarconi, @EightTrack180, @LockStockBarrl and a number of others.

Now a team to help.

Digging In

I reached out to Xpel sales and installers. The goal was to get a feel for the incentive structure and qualitative aspects of the business.

Everything was pointing in the right direction about the CEO Ryan Pape and the inner workings of Xpel.

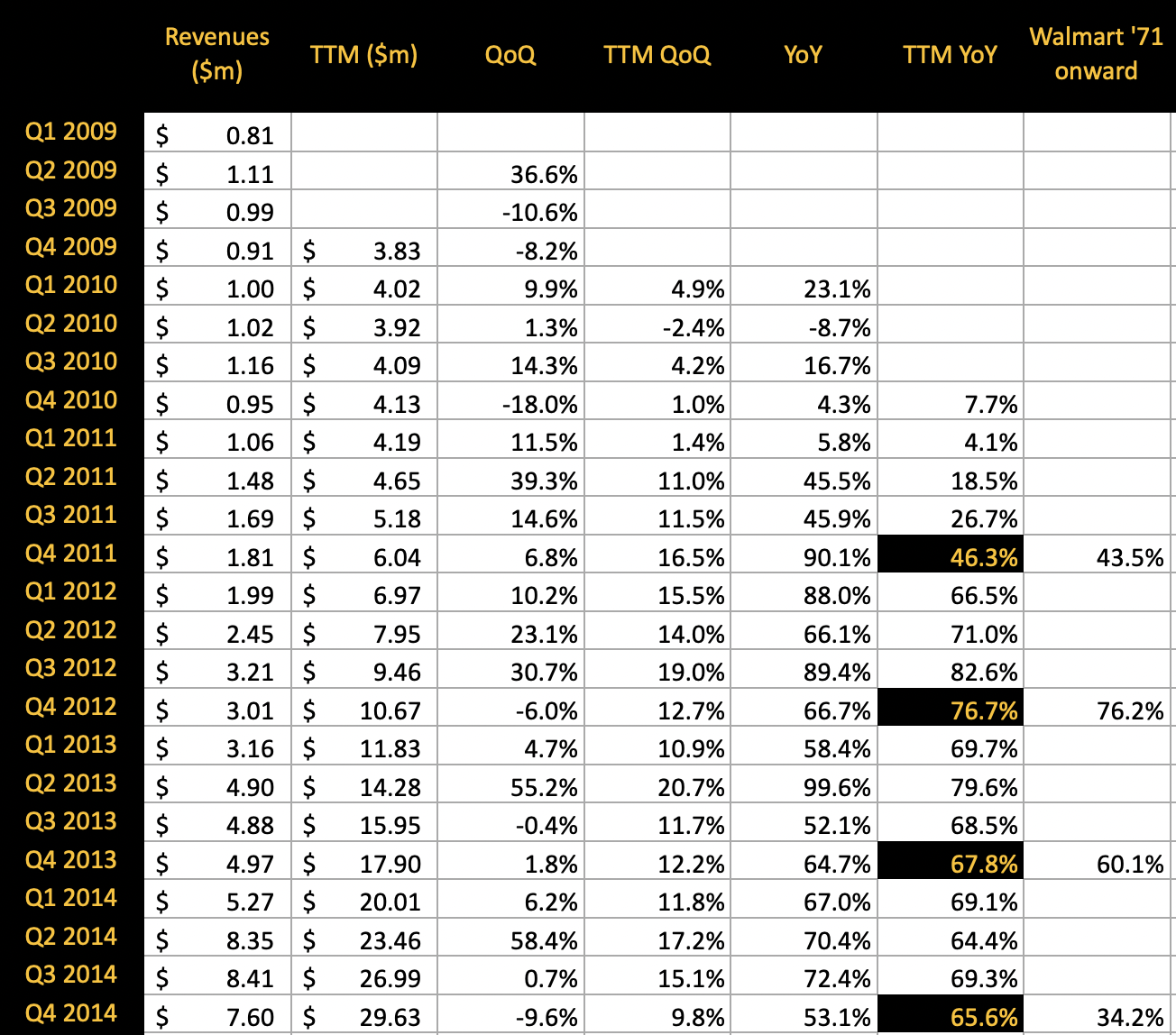

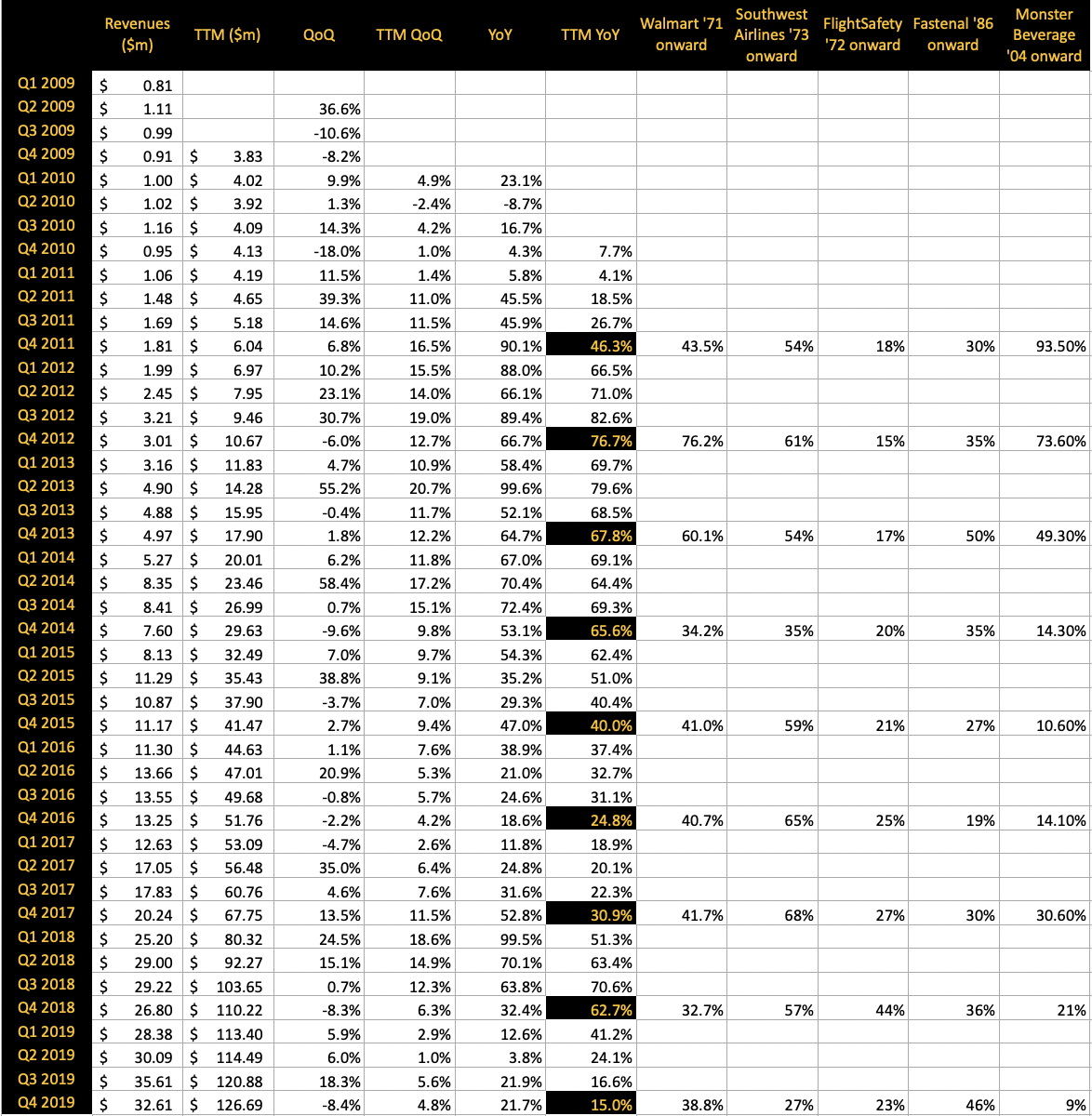

I wasn’t surprised because management didn’t get stock options. And for 10 of the previous quarters Xpel’s revenues had been going up, up, up and up. ROIC >50% 🤤

This was the type of track record that Wal-Mart had before going public that I was looking for.

Profits hadn’t gone as explosively higher, however. That was fine. The company was reinvesting heavily back into the operations.

In November of 2014, I wrote up my comparison of Xpel with early Wal-Mart.

I thought this picture said it all:

Now you don’t get that type of growth without giving customers what they want. Remember, that was Walton’s guiding principal from above.

And you don’t grow like that without communicating, building a great team, building a market, etc.

Price target a friend and I came up with on the high side was - $9.50. Assumed ~$400MM in mkt cap by year 5 based on $225MM in revs @ 18% EBIT and 10x multiple

$9.5 seemed impossible to reach from $3.

My more conservative estimate of Xpel’s share price was $6.

There are more details in the writeup if you want to read it: https://seekingalpha.com/article/2676825-xpel-technologies-wrapping-up-a-sticky-model-and-hyper-growth-worth-multiples-of-todays-price

And with all of the people in MCC jumping on board, I was both nervous and comfortable.

Nervous that herd mentality was in full force. Xpel had gone up 1,893% already.

It’s also comfortable to be in the company of very smart people. People with way more experience.

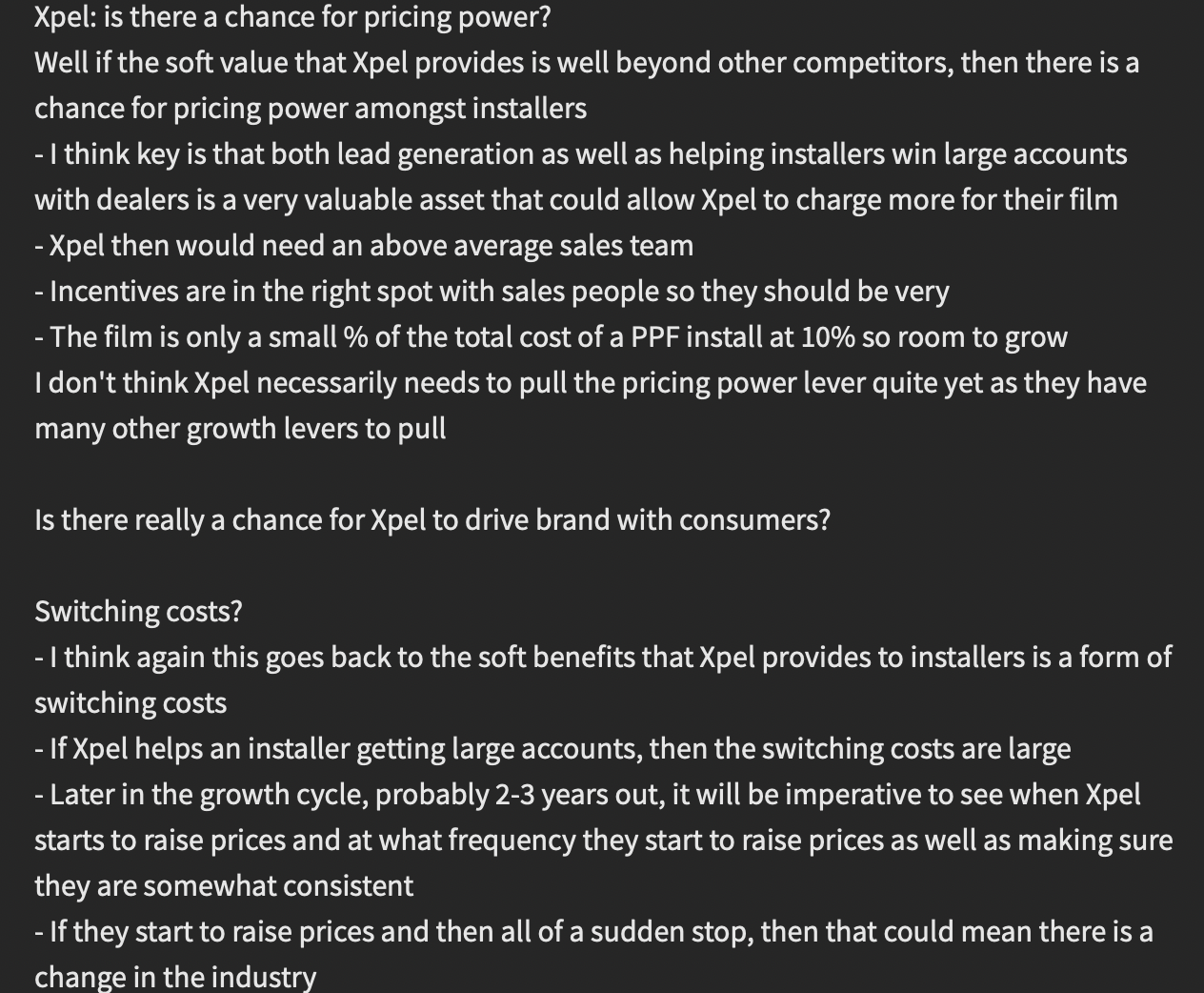

Looking through Notes 2015

In Feb ‘15, I wrote:

In essence, Xpel being a great partner to installers is a significant advantage.

The stock started falling when Xpel put up 53% revenue growth.

Pape had previously signaled potentially higher results. Investors punished the stock.

Pape learned his lesson and showed his straight shooter style during Mar 31, 2015 CC saying:

It’s important to note that as the numbers get bigger the revenue growth percentage we have seen will moderate somewhat not an aggressive reduction from the great growth we’ve seen this year but its probably unrealistic to consistently deliver growth in excess of 50% as we get larger.

Looks like Xpel was 30% position in Apr ‘15. I wrote to some people I invested for:

When asked Ryan Pape if he would sell the company, he didn’t think too much about it, although knowledge that the strategic decision they are making now will have an impact on who they could be attractive to. He said company is “in the automotive sector”, with strong relationships with dealers and installers, so there are a lot of room to grow.

And when asked about growth: New film applications and new products to existing customers - window tint being 1st test.

He said if window tint becomes successful it could be a huge part of the business and the start of a larger strategic push for new products.

That signaled to me that Pape was thinking very long term. And the internal reinvestment opportunities were many.

The stock price sat 15-20% below highs. Not that hard to handle when overall my position was up.

Then in the summer it started to heat up again.

Intelligent Fanatics

During this time I found @Sanjay__Bakshi ’s writeup on Intelligent Fanatics (https://fundooprofessor.wordpress.com/2015/07/10/intelligent-fanatics/). This reminded me I needed to finish my work on tracing back the path of great businesses and leaders.

I went back to my notes. Charlie Munger talked about John Patterson and National Cash Register. I immediately went to the library and took out a book on Patterson.

My neighbor had mentioned that he was writing a book and I thought gee, if he could do it, I could too. It’d at least give me a concrete goal to help sort my thoughts on great leaders. I thought it would be a nice compliment to William Thorndike’s book Outsiders.

Over the next few weeks I repeated my thorough study in the library. I read every article, book and piece of paper on John Patterson and National Cash Register.

I wrote a draft and for some reason thought it was wise to send it to a few people I admired… I sent a physical copy to Charlie Munger, Peter Lynch and @iancassel 🤣🤣🤣

Don’t get me started on where I found their physical addresses. Munger and Lynch probably threw the huge envelope in the trash.

Ian, on the other hand, got back in touch with me. He too had read Bakshi’s writeup on Intelligent Fanatics and wanted to team up on writing the book.

Over the next months, we charted out companies to write about. I wanted to dig deeper into those mentioned by Charlie Munger Simon Marks & Les Schwab.

We decided Sol Price, the guy Sam Walton stole everything from and Herb Kelleher of Southwest Airlines would be good adds, etc.

Holding

By now Xpel’s share price started retreating.

Growth started to slow in China, currency headwinds and continued high sales general and administrative costs (SG&A).

On Sep 1, 15, I wrote:

With these high quality companies I think it boils down to a) is management capable of running a substantially larger company and b) is management fanatically pursuing the goal of running a substantially larger company.

I think Ryan’s last statement from the CC and his actions over the years check both of those points. Here is that quote, “Obviously we are looking at all possible ways to expand the business. We have no shortage of initiatives to sort of identify over time the best strategy. So I can’t comment specifically, but it’s something that we are actively engaged in and our desire as we stated multiple times is to build a business that’s substantially larger. And so in order to do that we are going to do more and different things over time and we actively look to do that.”

Holding It all Together

This is about the time I started working at a non-profit to make ends meet. Before I had just writing articles on Seeking Alpha.

I did not want to sell my Xpel shares.

Still I felt like a loser because I was not able to convince many individuals to invest with me. At least I could work on the book project in my free time.

Simon Marks of Marks & Spencer was next. Then it was Herb Kelleher and Southwest Airlines.

Ian and I started noticing a pattern with these Intelligent Fanatic led organizations. The leaders led by example, had high integrity, treated employees well, operated at first in a small niche later expanding their markets and architected an extremely well oiled team culture.

Then December 31, 2015 happened.

3M hit Xpel with an IP lawsuit and the following happened

I was working at my job when I heard the news and wanted to 🤮🤮🤮🤮🤮

Xpel was still a very big position for me and those I invested for.

I wanted to hide. I felt like a fraud.

Pattern Recognition Coming In Handy

I remembered the huge sell off from Wal-Mart in the early 70s.

The story of Southwest Airlines I felt was helpful too. Herb Kelleher, while co-founder, was the company’s legal council. Braniff Air and other incumbents were set against Southwest never flying its first flight. It took years before SWA could fly.

I also wrote about Braniff trying to kill SWA off with lowering fares ala Standard Oil

I felt Xpel’s corporate culture was above average and Ryan Pape was swift enough to come up with something creative to combat 3M.

I found more parallels between the fanatics I was reading about and Xpel. I.e., John Patterson owned a piece of NCR and was on the board. The company, led by CEO George Phillips, was doing very poorly. Patterson came up with a plan to help sell machines. Phillips turned him down.

Patterson sold his shares. But after a trip he decided to buy the shares back and take control over NCR.

Phillips sold him his shares for $6,500. Patterson then was the laughing stock of Dayton Ohio. Patterson tried to sell the company back, but failed.

Patterson then proclaimed Phillips would be sorry.

Contrast that story with one I recall hearing of Ryan Pape. He was employee #12 in Xpel in 2004. Then it was more software based. He left in 2008. But came back in 09. The previous CEO had low expectations for Xpel. When Pape became CEO, mind you Xpel was $0.01 a share, the old CEO said good luck getting the stock to $1. Pape said we’ll be seeing $10 and more.

A Little Help From My Friends

Back in MCC, it was nice to be in the same room as an IP patent attorney (with a focus on material science) to provide some insight into the weight of the lawsuit.

Each new piece of the Intelligent Fanatic puzzle helped me understand how the pieces fit together into a multi bagger.

During the lawsuit, Xpel’s stock felt like it was going no where. It took foreeeeever.

In reality, Xpel was continuing to execute like

Eventually the lawsuit was settled and it felt GREAT. But the stock was again going nowhere.

I added through this time, but it didn’t matter how much read learned, I still felt stupid. Especially when trying to convince people I managed money for that Xpel was a special company.

According to the stock price I sure wasn’t.

From 2017 to 2018 felt like forever.

- Would the company ever uplist in the US?

- Would Xpel’s SG&A spend not grow as fast as %age of revenues?

More Help From History

More case studies helped me through this time.

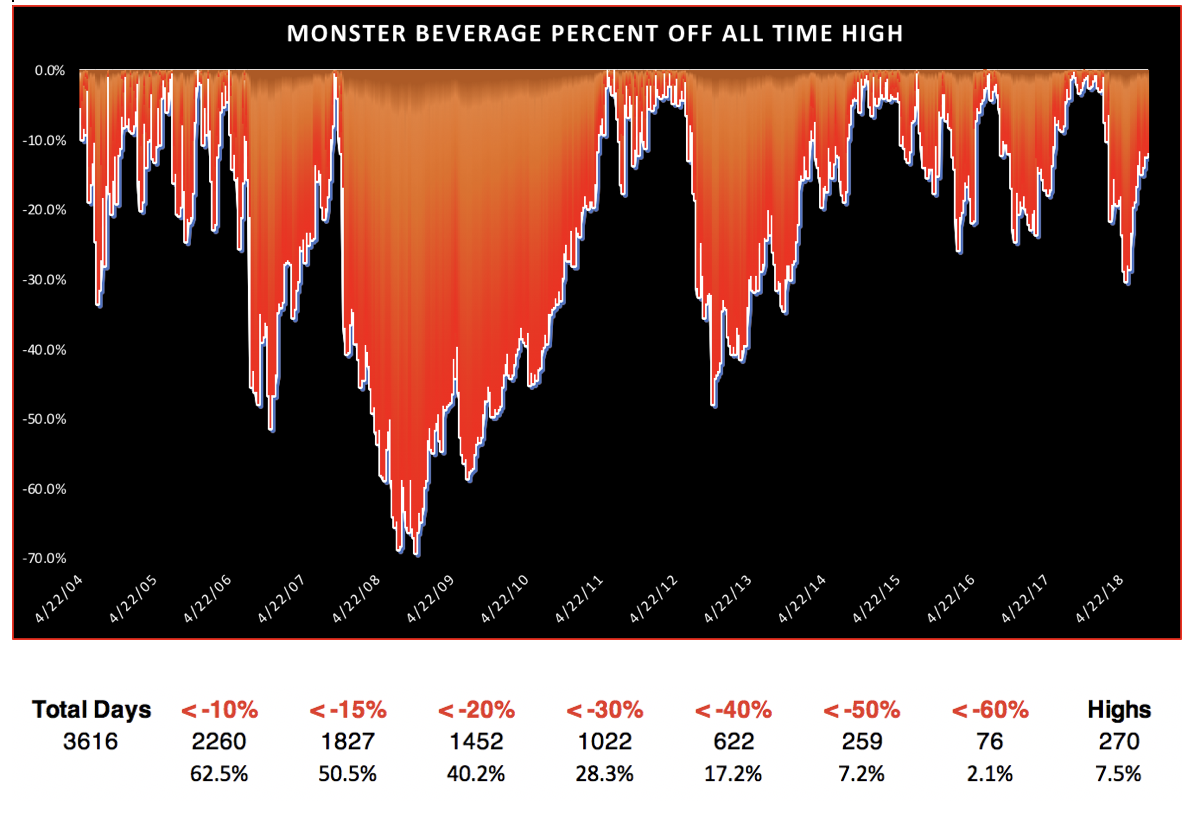

Specifically, $MNST Monster Beverage.

That too was a beast to hold. The draw downs were worse than Wal-Mart:

Rodney Sacks, like Ryan Pape, was a straight shooter CEO. I noted Sacks saying:

And I really was impressed with MNST’s management creativity. The company announced a unique marketing initiative with a train way back in ‘04.

The cost wasn’t huge. The company had been paying a marketing firm, $850,000 a year to display their advertisements in all their client’s stores. And the return was pretty phenomenal. The marketing director said:

Ah, a million dollars is nothing. I’ll cut a deal with our marketing firm to sell them the visibility for commercials on the train. It just happens to be I’m gonna give them an $850,000 tab on that.

Simply, the company reduced their advertising payment to $150,000 for displays in all stores, and got the monorail advertisement for free. Genius, right?

The type of marketing (brand building) Xpel was doing was similar. One example that sticks out is the Guinness World Records Tint Challenge.

CEO of Sunstoppers Mike Burke, an Xpel installer, got the idea during an Xpel Dealer Conference. How many cars could his team tint in a day. Ryan Pape loved the idea and he and his team helped set it up.

170 cars were tinted. That small cost of film, time and space probably was one of the best ROIs on marketing spend for Sun Stoppers, Xpel & the dealership where it was hosted at.

That clearly demonstrated Pape’s ability to listen to his installer network and set up win-wins for everyone involved.

Executing

And remember how I talked about a leader having integrity? Meaning do as you say, say as you do.

Pape’s idea of increasing Xpel’s product portfolio and film applications worked. Xpel’s window tint has been successful and has been only the beginning of their strategy.

Another addition, when Xpel was having growth pains in 2017 many investors were put off.

I, on the other hand, saw Xpel’s “getting close to the customer” strategy as askin to Mort Mandel’s idea of “killing yourself for your customer” with his company Premier Industrial Corporation.

I actually sent the story to Ryan in May ‘17.

At 11am on a Saturday in 1990, a representative from one of our biggest customers, Disney, called our Orlando branch office. The phone was answered even though the office was closed because we had 24-hour coverage seven days a week.

A major amusement ride at Disney World was down. Disney wanted to know if we could get them a part needed to get their ride up and running. A representative called our warehouse in Chicago. That part was immediately picked off a warehouse shelf and driven to O’Hare Airport for a 2pm flight to Orlando. In Florida, the salesman on the Disney account met the plane at out 4pm, jumped in the car with the part and called Disney to let them know that he would arrive there in less than an hour. At about 4:40pm he pulled up to the gate where they were waiting for the part. A Disney mechanic installed the part in minutes and the ride was up and running at about 5pm. Total downtime roughly 6 hours. Disney feared that it would take until mid day Monday to get that ride back in operation. So instead of actually losing 6 hours, the company assumed it would lose a couple of days.

Disney estimated that the downtime in this equipment would have cost it $1,000 an hour. Bottom-line, we may have saved our customer as much as $20,000 by responding so quickly and flying a $42 part from Chicago to Orlando and then having a salesman drive it straight to the park on a Saturday afternoon. Two weeks later our branch manager in Orlando got a phone call from a senior executive at Disney. “I have your invoice for $42,” he said. “I know what you guys did, send me an invoice for $500 or something. I’m embarrassed that you are not charging enough for what you did.” Our manager responded, “You are a valued customer. We send you many shipments during the year. Most of it goes through smoothly and we make a nice profit on it. When you need us, we’re there and we don’t charge extra for that.”

How many times do you think the executive at Disney told that story? What do you think happens when someone walks into Disney and says, “I know you’re buying your parts from Premier. Whatever you are paying, we’ll give them to you for less.” He most likely would turn that person away.

The response? Thankful for the story as it was totally appropriate to their current situation.

Going All In

This is about the time I felt it was necessary to go all-in on Xpel.

Did I sleep well? I think so. All of my studies, all of the help from friends, company execution and experience made it seem like a no brainer.

Xpel has been very difficult to hold since 2014:

Since 2011 Xpel shares have been down from highs:

- [>20%] 47% of the time = 867 days

- [>30%] 37% of the time = 681 days

- [>40%] 31% of the time = 568 days

- [>50%] 24% of the time = 434 days

- [>60%] 18% of the time = 326 days

- [>70%] 7% of the time = 123 days

- [>80%] .27% of the time = 5 days

Comparing with Wal-Mart and Monster, Xpel’s draw downs were SIGNIFICANTLY worse.

I started selling as I started a new business in 2019, but when the shares dive-bombed in March 20, I bought some more.

I only hold a fraction of what I once had, but will continue to hold. This is the company and this is the team that I believe embodies a great business.

Here is comparison of Xpel with other fantastic businesses of the past:

Now and Beyond

Now I have built a successful business, time to do what I want and have been blessed to be surrounded by great people. That I think is the Holy Grail.

Thank you $XPEL and thank you @RyanLPape

Now it is time to put that Intelligent Fanatic knowledge into use for myself as an operator of https://www.immersionfactory.co

and Inpīr 3D Wallart coming soon.

Because I’m still trying to figure it out

If I have any advice - go sign up at www.microcapclub.com

Build your pattern recognition of great businesses. Read Intelligent Fanatics Project https://amzn.to/3brhelI

Read Standing on the Shoulders of Giants https://amzn.to/3chg1Nn

Read Intelligent Fanatics of India https://amzn.to/2MXs3md

Do your own deep dives into those companies and more.

I’ll be sharing more in-depth write-ups here. Sign up 👇